Phenomena S2 E8: Money

Why the finance sector is out of sync with people’s experience of money, and what to do about it.

Money is one of the great stressors of our age, and learning to manage our finances one of our most important life needs. So why do the financial products we are offered still feel so out of sync with how we really experience money?

In this episode, host Eliot Salandy Brown sits down with Martin Gronemann, a partner at ReD Associates leading our work in finance, and John Dalton, Vice President of Research at the Fidelity Center for Applied Technology, to unpick how social science is helping banks build richer interactions with people.

How do some executives misunderstand young people? What are the key emerging financial practices to watch? How has the digitization of financial tools made managing money even more overwhelming? And how might introducing productive friction help us make better and more informed financial decisions?

Episode 2 of our new podcast, Leading with Perspective, where Alvin Lu, CEO of Kodansha USA Publishing, speaks about how to embrace uncertainty and channel chaos as the leader of a legacy brand.

A special live episode of the ReD podcast, where ReD partners and guests explore what makes a metric meaningful as part of our special series on Authority.

Episode 2 of our new podcast, Leading with Perspective, where CEO and change management expert Mads Ryder discusses the do’s and don’ts of mobilising change within organisations.

Episode 1 of our new podcast, Leading with Perspective, where leading strategic thinker Roger Martin discusses the art of good strategy execution and the role of culture in strategic thinking.

A special edition of our podcast live from NYC as we discuss AI and its impact on the body with Vivienne Ming and Richard Newcombe.

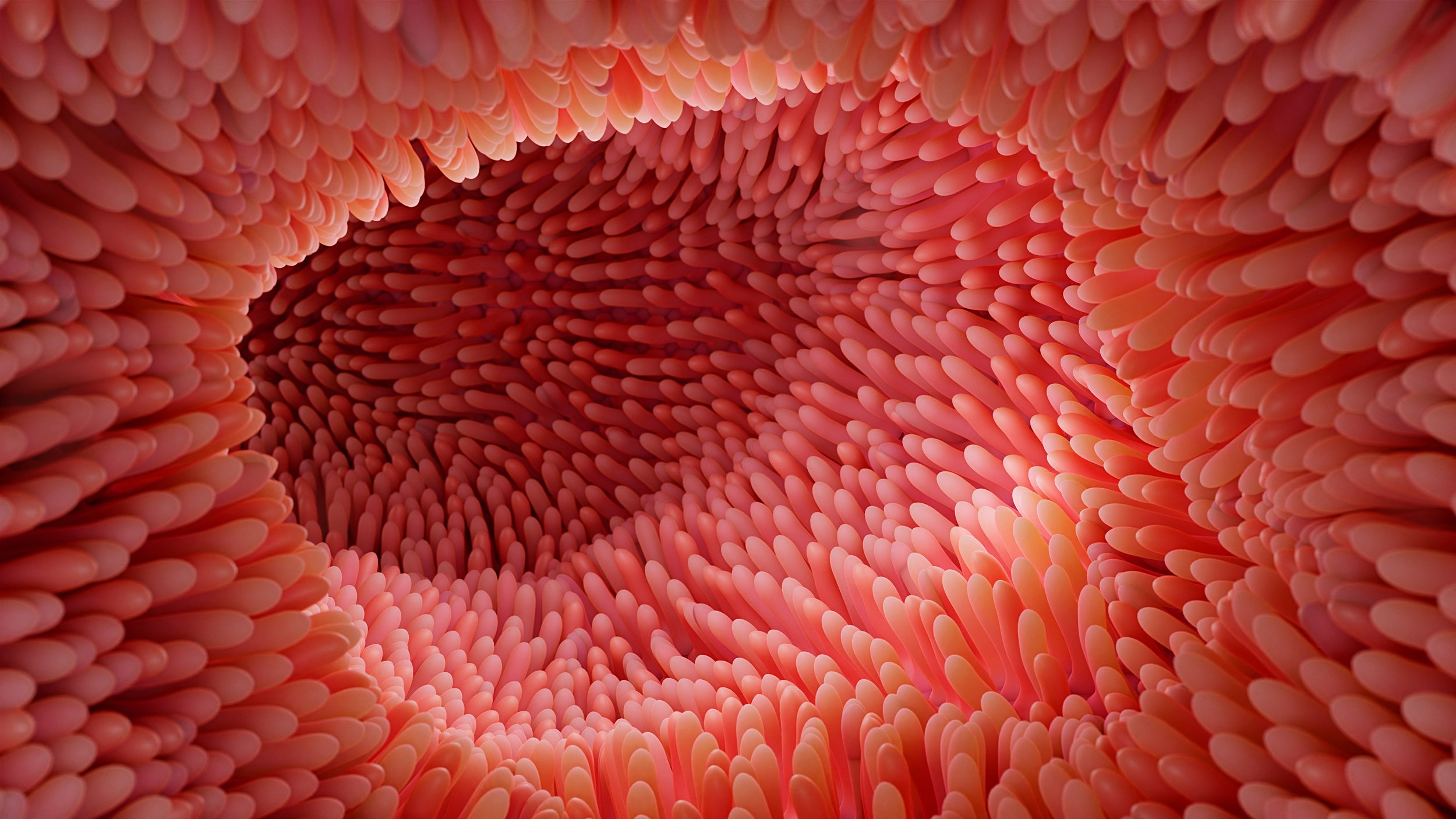

A special edition of our podcast live from Copenhagen, Denmark, where we talk to Oluf Borbye Pedersen and Theis Brydegaard on all things gut, social eating and adherence.

A special edition of our podcast live from Paris, France, where we talk to British artist Maisie Cousins and Pernod Ricard’s head of cultural foresight Daphnée Hor about the body, perishability and the germ renaissance.

Episode 9 of season 2 of our Phenomena podcast with Sandra Cariglio and Polly Rodriguez – does sex still sell?

Is understanding young people the key to building better relationships between financial institutions and consumers?

To what extent does the metaverse mark the next paradigm shift in how we work, play, and learn as humans?

Is strategy becoming a lost art? We speak to Roger Martin, one of the most influential minds in business and a trusted strategy advisor to global CEOs on the sorry state of strategy today and what we can do about it

Big, small, and connected – do brands still matter? We unpack what the latest thinking in social science and neuroscience can tell us about the connection between people and brands.

How can a more social and cultural understanding of mental health offer better solutions to care?

Is an overemphasis on shallow belonging contributing to a crisis of loneliness?

What can we learn from the luxury industry about making sustainability sustainable?

From fashion brands to Silicon Valley giants, virtually every company is trying to make algorithms work for their business.

Check out ReD Associates Partner Millie Arora podcast interview with NYSE's Inside the ICE House.

This podcast explores which problems require interdisciplinary collaboration and how teams with radically different world views can get it right.

This podcast explores “selection bias” by interviewing a conspiracy theory debunker and a conspiracy theorist.

How should companies understand cultural signifiers in order to capture the spirit of a generation?

Eliot heads ReD Associates’ mobility/automotive practice. In this work, he leads projects that set strategic directions for how mobility and automotive companies approach the challenges and opportunities facing the industry. The projects under his leadership include a foundational study investigating the future value of driverless cars to our cities and communities, and a new approach to digital service innovation for a major automotive company. In all of his work with clients, Eliot is focused on ensuring that human needs and behavior are fully integrated into the development of new technologies.

He has lectured and run courses on automotive, corporate strategy, and executive MBAs at New York University, Columbia University, Copenhagen Institute of Interaction Design, Art Center College of Design in Los Angeles, and Duke University; and his client work was awarded the Gold Award in 2018 from the Industrial Designers Society of America (ISDA). Eliot, a British-Trinidadian, holds a Masters in Sociology from the London School of Economics.